BCG InstituteBCGi

EEO-1 Reporting

Since 1966, the Equal Employment Opportunity Commission (EEOC) has required certain employers to annually report on their workforce demographics through what was officially designated as the "Equal Employment Opportunity Employer Information Report," but most refer to it simply as the "EEO-1."

These reports have historically come be be viewed as relatively "low-risk" in terms of the degree to which the information can be used against an organization, and relatively "low-effort," especially as Human Resources Information Systems and such began offering automated report-generating features, including spitting-out EEO-1 reports.

However, for federal contractor employers, the EEO-1 reporting obligation recently got more complicated. Federal contractors now have to consider the degree to which various other federal reports they are required to file "line up," particularly the EEO-1 reports and affirmative action plans (AAPs). And those automated EEO-1 report-generating tools are not taking the intersectionality of your various federal reporting obligations into account. In other words, federal contractors would be wise to avoid such automated reporting options.

If you need help with your EEO-1 reporting obligations, Biddle consultants are expert at not just filing "compliant" reports, but also developing an overall federal reporting "strategy" that is now essential.

The EEOC does maintain a fairly robust "landing page" (external link) for EEO-1 filers that contains a lot of useful information, including the "EEO-1 Instruction Booklet," linked-to on that page (the EEOC tends to update that document each year and change the name, breaking everyone's links, so just find it on the landing page).

Do We Have To File?

If you are an employer that is subject to Title VII and employs 100 or more workers, you must file annual EEO-1 reports.

Additionally, if you are a federal contractor that is required to prepare affirmative action plans (AAPs) under Executive Order 11246, and you are either a prime contractor or a first-tier subcontractor, you must file annual EEO-1 reports.

Many employers will meet both requirements and simply file EEO-1 reports each year as a matter of course, rather than try to determine each year whether or not the requirement applies. Even if an employer isn't technically required to file in a given year, in large part because starting and stopping invites conversations with people from the EEOC. There is no penalty for filing if not required to do so.

If your organization is not a federal contractor, understand that most organizations with 100 or more employees is also going to be subject to Title VII, so don't drive yourself nuts trying to figure out how one can have 100 or more employees and not be subject to Title VII. You are exempt from this prong if you are a "religious organization" or a "religious educational institution." But if your organization is also a federal contractor required to prepare AAPs, there is no religion exemption, so you are still required to file as a federal contractor.

Make Sure Everyone Files!

If your organization is comprised of multiple "entities" with different Federal Employer Identification Numbers (FEINs), you may need to file EEO-1 reports for each FEIN, especially if your organization is trying to maintain "legally separate" entities.

Note that some automated EEO-1 reporting tools are actually filed under the umbrella of the vendor that provides that tool, rather than the organization actually reporting. That could impact the results of a "single entity test" and "undo" some of the separation your lawyers have worked to hard to create. When in doubt, consult with your legal team on EEO-1 reporting structure.

When Do We Have To File?

The current deadline for filing 2022 EEO-1 reports is December 5, 2023. Those reports will be based on a "snapshot" representing the end of a pay period that falls between October 1 and December 31, 2022.

The "when" has been in flux the last several years, but typically EEO-1 reporting "season" has been in the Fall. Originally employers were required to choose a "snapshot" date representing the end of a pay period between July 1 and September 30, then file their actual reports in October/November.

That changed several years ago when they added "Component 2," which was an additional report showing total earnings and hours worked for the employees being reported. The snapshot on which reports were based still had to be taken between July 1 and September 30, but since employers were newly required to report on total earnings in a 12-month period, they added December 31 as a snapshot date option and moved the reporting "season" to the following Spring.

Component 2 was abandoned, but the snapshot periods and filing season did not change. And that is how we end up filing our "2022" EEO-1 reports in the calendar year 2023 (using a 2022 snapshot).

What Do We Have To File?

The EEOC used to refer to different types of EEO-1 reports by number. For example, the standard establishment report was referred to as a "Type 4," while an establishment report for a corporate headquarters was referred to as a "Type 3." As of the 2022 filing season (in 2023), the EEOC has dropped these "type" designations. Instead, they refer to the various reports by a descriptive name, like, "headquarters report."

Employers with just one work location will file the "Single-Establishment Employer Report," which is exactly what it sounds like. It is one report to cover the employees at your single work location. (It isn't a Headquarters Report because "headquarters" implies that there are other "quarters.")

Employers with multiple work locations are referred to as "multi-establishment" employers and is required to file three different types of reports; Headquarters; Establishment-Level; and Consolidated.

The Headquarters Report is for whichever location represents your "main office." Some organizations have "fluid" or otherwise non-traditional structures and may not operate anything that could be reasonably described as a "headquarters." Try not to over-complicate life and tag the building where you're most likely to find the President or CEO.

Each "non-headquarters" location will get its own Establishment-Level Report, regardless of size. Employers used to have the option to report establishments with fewer than 50 employees on a "Type 6" establishment list, but that option was eliminated with the 2022 reporting cycle. From 2022 forward, all establishments get their own report.

Finally, multi-establishment employers have to file a Consolidated report representing the totals in all other reports.

Report Contents

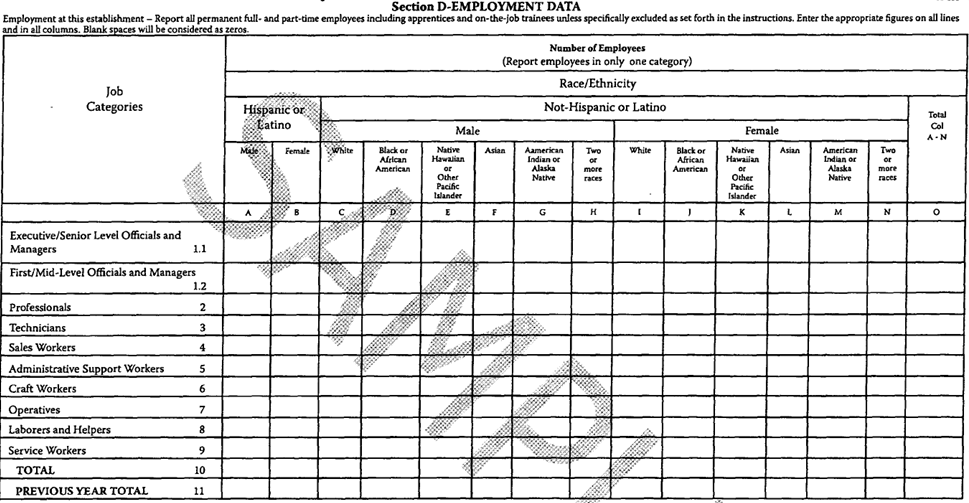

The "main" part of the EEO-1 is a simple grid referred to as "Section D - Employment Data." Primarily the EEOC is interested in how many people you employ at your various work locations according to 10 EEO-1 "job categories." These job categories are defined in the EEO-1 Instruction Booklet, which can be found on the EEO-1 landing page (external link).

Each report will show headcounts of employees on your payroll as of your chosen snapshot date. And those headcounts are reported by job category, sex, and race/ethnicity.

Filers will also need:

- The name and address of the parent company (if applicable);

- A "name" for each establishment (naming convention is entirely up to you);

- The FEIN associated with each establishment (note you can have more than one FEIN operating out of the same location, which should result in multiple EEO-1 reports for that location);

- The snapshot date used;

- A description of the "major activity" of the establishment (example: "manufacturing steel casings");

- Name and job title of the "certifying official" (the person on the hook for the data being accurate); and

- Name, job title, and contact information for the person to contact if there are any questions about the report (which can be the same or different from the "certifying official").

Filers will also have to indicate whether or not an EEO-1 report was filed for the location last year, and there is a section where they must answer jurisdictional questions using "yes/no" checkboxes. Specifically:

- Does the entire company have at least 100 employees?

- Is your company affiliated through common ownership and/or centralized management with other entities in an enterprise with at least 100 employees?

- Are you a federal contractor required to prepare AAPs?

Filers who check the federal contractor box must also provide a Dun and Bradstreet identification number, if you have one.

On the way out, the "certifying official" must certify that the reports are accurate (to the best of the official's knowledge) and prepared according to the EEOC's instructions.

Historically the EEOC has allowed third-parties to file and "certify" on the organization's behalf, meaning you can fob this whole project off on a consultant if you want to.

How Do We File?

The days of filling out and mailing in paper forms are pretty much gone. It is still technically an option when and if all other options are unavailable, but in any case not without permission from the EEOC.

There are really only two options. Smaller and less complicated organizations might choose to log in to the EEO-1 "portal" and input their data manually, essentially filling out the forms electronically.

Larger and more complex organizations will want to avail themselves of the data "upload" option. Filers can prepare what is basically a spreadsheet with all the required data and upload that file to the portal. Data upload format and instruction can be found on the EEO-1 landing page (external link).

Interaction With Other Reporting Requirements

Federal contractor employers are likely to be required to file annual EEO-1 reports, VETS-4212 reports, and prepare annual AAPs. And in the past, these three things had little to do with one another. Traditionally these employers focused on their AAPs and let the EEO-1 and VETS-4212 reporting become just a rote exercise that was given little thought beyond worries that EEO-1 data would be released to the public through a Freedom of Information Request (a well-founded fear, as it turns out).

But then the OFCCP implemented their "Affirmative Action Program Verification Initiative" (AAP-VI). The OFCCP is now paying very close attention to differences in EEO-1 and AAP "structures." More to the point, they are increasingly asking contractors to explain differences between EEO-1 and AAP headcounts in audits, despite the fact that for many employers those numbers typically do not match due to differences in the two reporting requirements.

And if the OFCCP has reason to believe that an organization should have verified its AAP compliance through the AAP-VI (referred to now by the OFCCP as the "Contractor Portal"), but the organization did not verify, they tend to send an audit letter to find out what is going on. One of the ways they anticipate who "should" verify their AAP compliance is by noting whether or not you checked "yes" on Box 3 in Section C (Are you a federal contractor required to prepare AAPs).

In other words, the OFCCP is now cross-referencing your various federal reports. So while up to a few years ago EEO-1 reporting might have been a kind of "set-it-and-forget-it" project, today that should no longer be the case. If you are a federal contractor and you have not considered how your various federal reporting obligations might interact--and developed a suitable reporting strategy--the time to do so is now.

Is There More?

The "devil" is always in the details, as they say, so yes, there is more to EEO-1 reporting than we cover here. Quite a bit more, once you sit down to do it.

The EEOC does provide relatively robust guidance, so the answer to most of your questions can likely be found in their Instruction Booklet (where they are now also consolidating "FAQs").

But you don't have to go it alone. If you need help, feel free to drop us a line at Info@Biddle.com and we'll see what we can do.